Whom Qualifies having a conventional Financial for the Virginia?

Let’s face it: Getting accepted getting a normal loan can be tricky, particularly for low- so you can modest-money homebuyers with quicker-than-finest credit. But not, old-fashioned fund have numerous positives. For 1, so it financing sorts of typically even offers far more competitive interest levels and higher credit constraints. Mortgage insurance policy is together with an aspect. While really FHA fund require PMI, old-fashioned finance only require it for individuals who set lower than 20% down.

FHA or Antique Financing? That is Ideal?

Whether you’re a first-day domestic client or a bona fide house guru, it is possible to ask yourself: What is actually greatest an enthusiastic FHA mortgage inside Virginia otherwise a traditional mortgage? On Dashboard, the Financial Instructors are confronted with it concern just about every day. We always share with home buyers so it would depend. For those who have a diminished FICO* score and restricted bucks, a keen FHA loan can work. However, in the event your credit rating is higher than 640 and you’ve got adequate bucks to have a bigger deposit, a conventional mortgage is much better.

Nevertheless not knowing and that mortgage choice is best complement? Contact Dashboard on the web or phone call 757-280-1994 to connect that have a mortgage Advisor.

Antique Financing Limits to have Virginia Borrowers

Extent you can obtain is determined of the lender. not, there are even more restrictions. Simply how much you might borrow relies on the creditworthiness, debt-to-earnings proportion, or any other items. Although not, individual lenders should also comply with criteria place by the Government Homes Loans Department. The latest compliant mortgage limit getting 2023 is $726,two hundred for almost all section. In some high-money a property components, consumers may acknowledged to possess financing around $step one,089,3 hundred.

- Your meet with the credit rating criteria 2400 dollar loans in Excel AL. Minimal credit history will vary away from bank in order to bank; however, very financial institutions predict a good FICO* get of at least 680. Dash even offers conventional fund to individuals that have score as little as 620. Simply remember that home buyers having a rating over 740 get the very best cost.

- You have got an acceptable loans-to-income ratio. Your debt-to-income ratio try determined from the breaking up complete monthly obligations repayments by the month-to-month revenues. Most loan providers like to see an obligations-to-income proportion of approximately thirty-six%.

- No significant credit file facts, like a foreclosure or bankruptcy proceeding.

- An advance payment of at least step 3%. Or even need to shell out PMI, you’ll need to establish 20% of the amount borrowed.

Version of Traditional Fund for Virginia Homebuyers

Traditional lenders are just like popsicles they show up in a lot of additional styles. Each kind of traditional financial is perfect for consumers with different requires. Unsure which is for you?

Read the traditional loans we provide, then contact a home loan Mentor here at Dash.

Identical to Mike Krzyzewski, their Home loan Advisor has arrived to make sure your credit procedure is an effective slam dunk. They may be able respond to all issues you’ve got about traditional fund in Virginia.

- Compliant Antique Financing: Meets criteria lay by Government Housing Money Service.

- Non-Conforming Antique Loan: Cannot see standards set by Federal Casing Fund Agencies.

- Virginia Jumbo Financing: A form of nonconforming antique loan you to definitely exceeds fundamental financing constraints.

- Fixed-Rates Mortgage: Old-fashioned mortgage option which have fixed interest levels.

- Adjustable-Rates Loan: Designed for individuals exactly who invited future develops from inside the money.

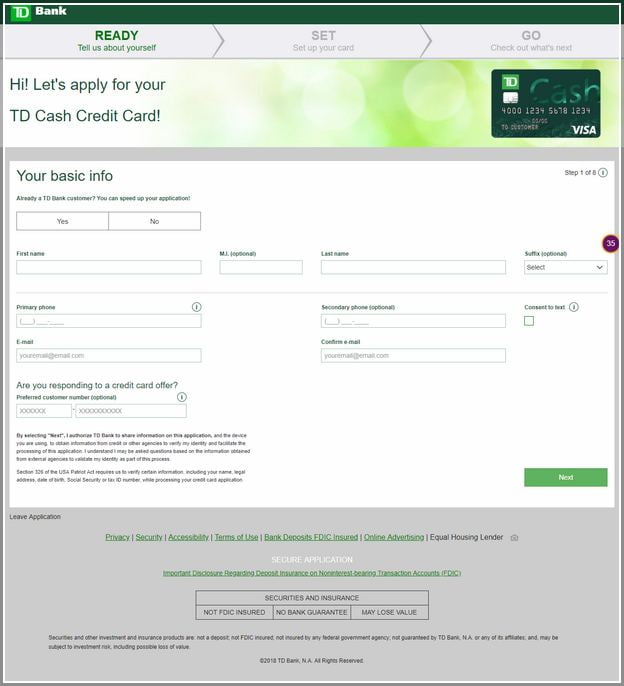

How exactly to Apply for a traditional Financing when you look at the Virginia

To apply for a conventional financing, you will need to fill out an application exhibiting your earnings, credit history, as well as assets, instance bucks, advancing years financial investments, as well as insurance. Mortgage lenders would also like to make sure you has several months’ worth of mortgage payments on the bank account in case there are a crisis.