Luckily for us, of a lot loan providers usually imagine more than just your credit rating

Collect Other Funds Files

As a result for those who have a faster-than-primary credit history, you might however tell you lenders that you will be gonna pay the borrowed funds giving other related financial documents. This proof are normally taken for:

- Proof earlier mortgage payment: If you possibly could let you know a lender a track record of finance, specifically car and truck loans, that you have were able to pay effectively, it may help her or him view you because an established customer. This can help cause them to become offer a far greater deal on the financing.

- Employment background: A reliable work record can show your own precision that assist establish a reliable financial situation.

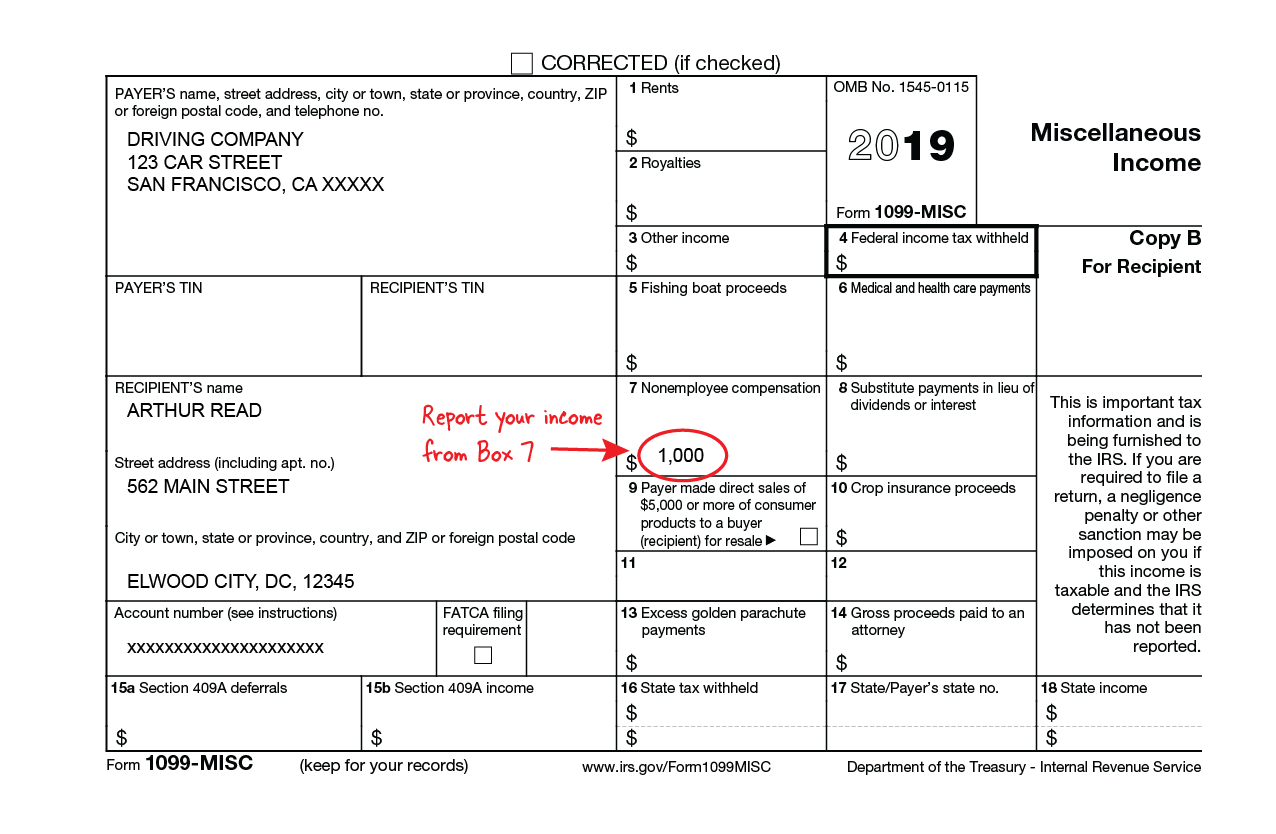

- Month-to-month money: Although your credit rating is lower, you could assist convince loan providers that you have the ability to pay-off the borrowed funds because of the showing them the monthly income. Be sure to include all of your current money supplies, plus money out-of an initial job, secondary perform, freelance work, impairment repayments, Social Coverage professionals, otherwise child assistance.

- Debt-to-income proportion: You can calculate your debt-to-income ratio of the breaking up their monthly debt obligations of the gross amount of cash you will be making where exact same month. If the proportion are below 50%, loan providers could see your due to the fact a much better candidate for an auto mortgage.

It is preferable to get this paperwork along with her at the beginning of the shopping processes, so that you get it willing to tell lenders if they inquire. You’ll be able to inquire further if they had want to see they if you see he’s reluctant to give the auto mortgage.

In the event your documentation shows an awful borrowing from the bank feel, such as a great repossession otherwise late mortgage payments, be prepared to give an explanation for activities to assist the lending company see why you to definitely happened and exactly why its impractical to happen once more.

Set a spending budget

Once you learn your credit score and now have predicted your own focus installment loans Magnolia rate, you might place a funds to suit your the new get. Believe means constraints for yourself about how precisely higher their monthly premiums should be and how many months you’ll think investing them.

This will be a highly beneficial device when you enter into transactions because the you can come in once you understand exactly what range you do not want in order to cross financially. Keep in mind that the latest stretched the fee label, the more attention you might have to shell out.

Since you believe exactly how much you can relatively pay inside monthly money, it’s also possible to take into account the time-to-date will set you back regarding automobile possession and you will factor him or her into the finances. Eg, consider:

- Gas money

- Regular maintenance fees

- Parking expenses

- Insurance coverage

Envision a deposit

A down-payment are a share of one’s vehicle’s price you to definitely you pay upfront. Particular lenders want down money, eg out-of buyers that have poor credit. Although they don’t require it, you might still imagine giving a down-payment within the offer.

In case your credit ratings was reduced, and also make a deposit may help lenders see that you’re serious regarding purchase and you have the money to support the financial support bundle.

This might cause them to become prone to make you a reasonable price to your a car loan, since having an advance payment on the table reduces the exposure that bank is actually trying out by providing the borrowed funds.

Because a plus, most of the dollars you expend on the down-payment is the one dollars less which you are able to have to pay back to car and truck loans. It means you can also end investing less of your budget by steering clear of appeal.

Research Bank Alternatives

The last action to prepare you to ultimately get an auto loan which have bad credit is to lookup different lender possibilities. That way, you’ll find a knowledgeable offer to fit your finances.