Just how much Unsecured loan Can i Avail that have good 20000 Paycheck?

Unsecured loans try preferred personal loans using the enormous pros such as versatile explore possibilities, short and you will difficulty-100 % free techniques and you may limited papers necessary to pertain. Whenever you are a great salaried individual and you will meet with the personal bank loan eligibility conditions specified, you can get it on the internet instantly.

Your qualification criteria is simply influenced by the blend out of issues such work details, kind of financing and its own period you intend to decide for, fico scores and the rate of interest billed thereon. Regarding all of the eligibility affairs, their monthly salary is an essential component that identifies the latest outcome of your personal loan application. This is because your earnings determines your own installment potential and that is a must for Clix Money.

Along with your payment strength depends upon the month-to-month net income in place of the latest fixed obligations. Essentially, such as for instance a proportion would be 50% and you may above to suggest a wholesome pattern of money and you can good solid loan repayment skill.

Simply how much Personal loan Can i Log on to 20000 Paycheck during the India?

The explanation for going for a quick unsecured loan should be varied debt consolidating, scientific emergency, wedding, degree, deluxe travel, house renovation, plus. When you go for an unsecured loan, they implies that your discounts are either ineffective to generally meet new expenditures to possess a certain purpose or you wish to keep deals and you will investment unchanged getting future explore. Almost any ount approve is basically centered on your earnings and you may borrowing from the bank get.

When you are bringing house a monthly salary of 20000 INR, you will be permitted apply for a personal bank loan out-of Clix Financial support (and additionally depending on its qualifications conditions). Here you will find the eligibility standards lay from the Clix Capital to possess candidates who wish to apply for a quick consumer loan:

- You need to be ranging from 21 and you will 58 yrs . old as entitled to an unsecured loan.

- Just be a living resident away from India.

- Your own minimal monthly income are going to be 20000 INR regarding all present

- For salaried individuals, you should be operating together with your newest organization to possess a minimum off six months and get a whole performs experience of a dozen days.

According to the above-stated eligibility standards, your loan application is processed and you can evaluated by the Clix Capital. Yet not, all round standards point out that the minimum Repaired Obligation in order to Money Ratio (FOIR) ought not to go over forty-50% of net income once taking into consideration the EMI off your current advised loan. For the unversed, Repaired Responsibility so you’re able to Earnings Proportion (FOIR) means the brand new ratio of one’s websites month-to-month money versus this new fixed bills like many mortgage EMIs, costs, charge card responsibilities, and. If it proportion are properly met and you be eligible for the fresh new eligibility requirements, your stay large odds of taking instant consumer loan acceptance.

Step-wise Way to Avail Quick Consumer loan toward 20000 Paycheck

Look at your credit history for free to obtain pre-certified even offers regarding Clix. Good credit is essential for your financial liberty, creditworthiness and certainly will trigger quick approval and you may disbursals. You are able to use the personal loan EMI calculator so you can get just what EMI package best suits you.

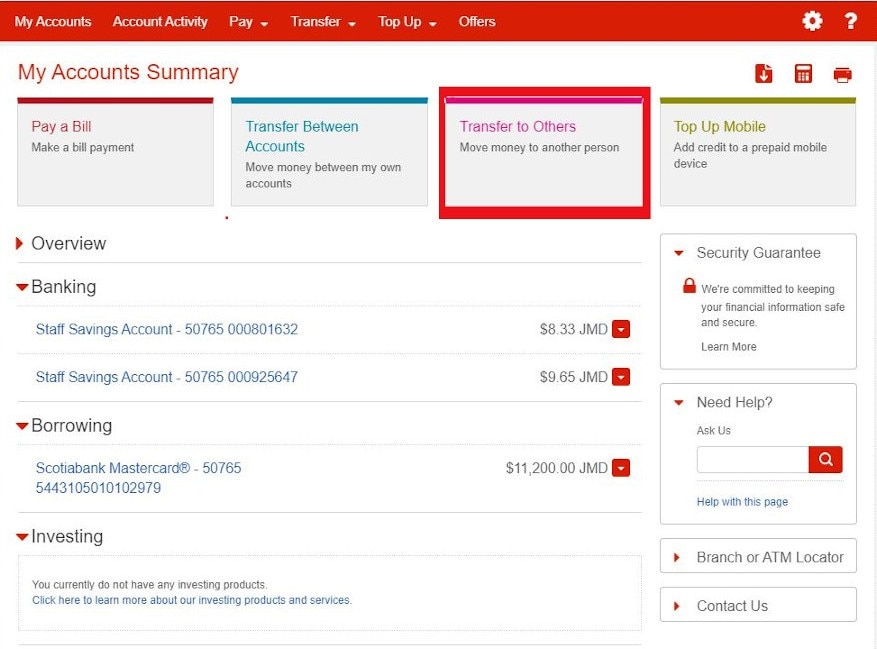

If you are qualified to receive a deal, when you get the credit history, Clix Capital’s program tend to show a deal that have a link getting that pertain. Click on Incorporate Now or look at the Consumer loan area, complete the on the internet application one to only takes three minutes, and publish your good documents. And over!

Depending on your credit score, if you’re qualified, we are going to suggest many safe unsecured loan preparations and supply in-depth factual statements about cost tenure, EMI matter, and you may interest levels. Check the pre-empted EMI that have a personal loan EMI calculator to learn the brand new EMI number in line with the amount borrowed, period, and you can rate of interest.

Once you have submitted the program and you may uploaded every needed data files, Clix Capital’s consumer user may label your for a simple conversation. In the event the what you goes really, yours loan would-be accepted. Well-done! The availed matter will get disbursed for you personally quickly.

How-to Replace your Qualifications private Mortgage Recognition?

- Change your Credit rating: Your credit rating performs a critical reason behind determining your personal mortgage approval opportunity and rate of interest so you can end up being charged on your financing. you can also be take advantage of an unsecured loan also from the a down credit history, listed here interest would-be highest to cover the danger of loan default. When you find yourself, on the bright side, a credit rating away from 630 and you may over is known as perfect for consumer loan approval and you will availing affordable interest levels. People with a high credit score was perceived as low-chance borrowers and the other way around. Look at your credit score sporadically and make sure your credit report is free of charge from errors. Often be timely together with your financing or credit card payments, usually do not close the old borrowing account, and you will improve one errors on the credit file to improve your credit history.

- Stop Obtaining Several Money immediately: Any time you submit an application for an unsecured loan, Clix Financial support monitors your credit score, that’s termed a painful enquiry. For folks who sign up for several funds at the same time, several thousand hard enquiries could make your credit rating drop. Constantly be sure to connect with a single financial at the same time and wait for response before carefully deciding next span of action.

- Pay off Current Funds and you will Credit: Because the chatted about significantly more than, the fresh new FOIR or obligations-to-income ratio is actually a major determinant of one’s own mortgage recognition. To alter which proportion, it is usually advised to settle your current bills prior to trying to get a new mortgage. This will decrease your newest obligations and you may change your discretion income at hand to pay for the latest advised mortgage EMIs.

- Declare Your earnings out-of Most of the Offer: If you are a salaried private, their monthly money throughout the workplace is considered the most essential one. Yet not, if you’ve almost every other resources of money such as for example lease regarding assets, passion with the dividends, passions towards dumps, while others; you should completely claim the fresh supplies. So it increases your income and you may enhances your own personal loan qualifications.

- Add an effective Co-Applicant: If you have the average credit rating or low income, you can incorporate good co-candidate on the loan application. This new co-candidate need to have a high credit rating and you will normal earnings in order to enhance your personal. The fresh new co-candidate may either become your lover, parents, or son.

From the Clix Resource, you can expect signature loans as high as ? ten lakhs on competitive interest rates. You can prefer a loan label out of credit union bad credit loans twelve so you’re able to 48 months considering your budget and you can fees capacity. When you make up your mind to apply for an individual mortgage , follow this action-by-action self-help guide to finish the on the web application for the loan procedure without the frustration.