What’s the Ideal Lender To possess Va Fund?

The average conversion try a 1/8 (otherwise 0.125 %) increase in your interest that will allow the lending company so you can pay closing costs equal to regarding 1 percent of the financing number. In the event the complete closing costs equal dos % of one’s mortgage count, the lending company can safety these with an effective 0.25 % boost in your own rate of interest. That can end in a very limited escalation in their monthly fee, which can help you save several thousand dollars in the out-of-wallet settlement costs upfront.

You’ll find countless home loan organizations and you may banking companies all over the country offering Virtual assistant lenders. But simply given that a lender also provides Virtual assistant fund doesn’t necessarily mean they have been good at leading them to really works.

In fact, of several loan providers do Va loans only occasionally although they highlight by themselves because the Va lenders. But an excellent Va financial try an alternate mortgage equipment, and requires special dealing with.

Because of this, I narrowed our very own listing as a result of the 5 finest Va household lenders. Besides are common five well-equipped to handle Virtual assistant home funds, but each works into a national basis. And that’s important, since the in search of accredited Va home loan lenders is somewhat such panning having silver. Certain might even claim to be specialists however they are nothing away from the sort.

You’ll end up well-advised to choose loan providers recognized for focusing in Virtual assistant lenders rather than those who offer them mainly as merely another line items to their equipment checklist.

What is the Lowest Credit score For A good Va Financial?

This new You.S. Agencies out-of Veterans Products will not county credit history standards having Virtual assistant borrowers but this doesn’t mean some one having terrible borrowing from the bank you will be eligible for a new pick loan. For each and every bank spends a unique laws.

You can aquire an excellent Va loan having a credit history just like the lower while the 580. If you https://paydayloansconnecticut.com/trumbull-center/ have loads of other obligations, the financial may require a get out of 620. This type of money has actually good financial prices, but finance companies can also be continue a knowledgeable interest levels for the extremely certified Va individuals.

Can also be Federal Shield or Coast guard Pros Use?

Sure, veterans of your own Armed forces Federal Protect and also the Coast-guard can be qualify for the brand new Va mortgage program once they fulfill specific solution requirements.

- Federal Protect: Need over half dozen numerous years of respectable solution or suffice into an enthusiastic productive obligation mobilization for around 90 days. Plus, people have been released because of an assistance-related handicap normally meet the requirements.

- Coast guard: Coast-guard veterans and energetic obligations services members be considered identical to veterans whom supported floating around Force, Navy, Army, otherwise Marines. In most cases you would must suffice at the least 3 months normally was basically discharged because of a help-associated disability.

Try Good Virtual assistant Loan Most effective for you?

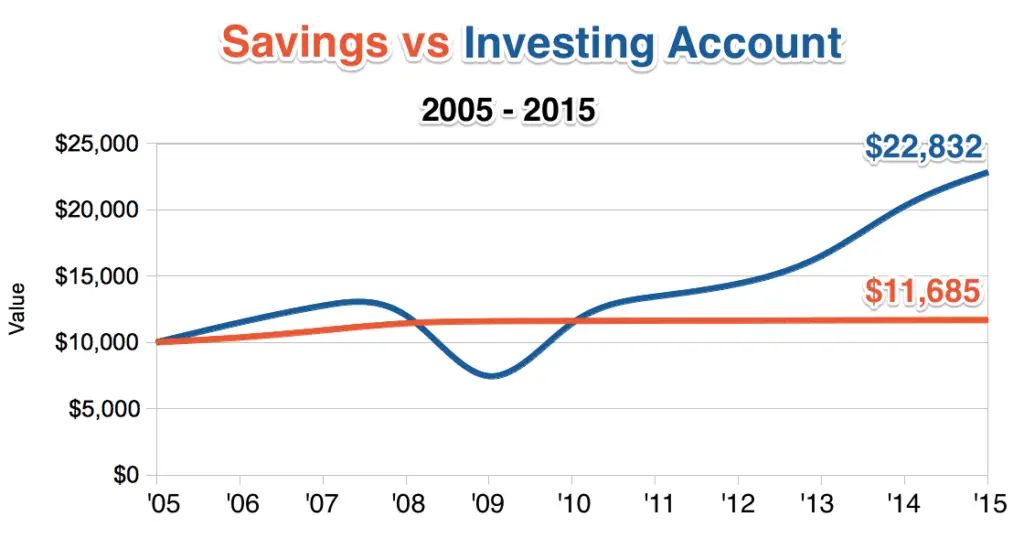

The brand new Va operates the financial system to greatly help pros get and you can refinance home due to the fact an initial house. Owning a home instead of leasing causes a very steady financial future, simply because the domestic collateral gets a good investment through the years. Later on in life, as security generates, make use of it money for any reason should you get a funds-out re-finance.

Antique mortgages would be brain surgery in order to secure, specifically for veterans transitioning regarding productive duty. Needed highest off payments otherwise constant PMI premiums. You could potentially invest instances with the an application only to come across your credit report disqualifies you otherwise that you’d you prefer a huge advance payment to meet the requirements.

When you’re a working responsibility person in the united states army or a veteran, along with Va loan qualifications, you can avoid a lot of the red tape banks want once you purchase or re-finance your home.